Why Soldiers Send Money Home

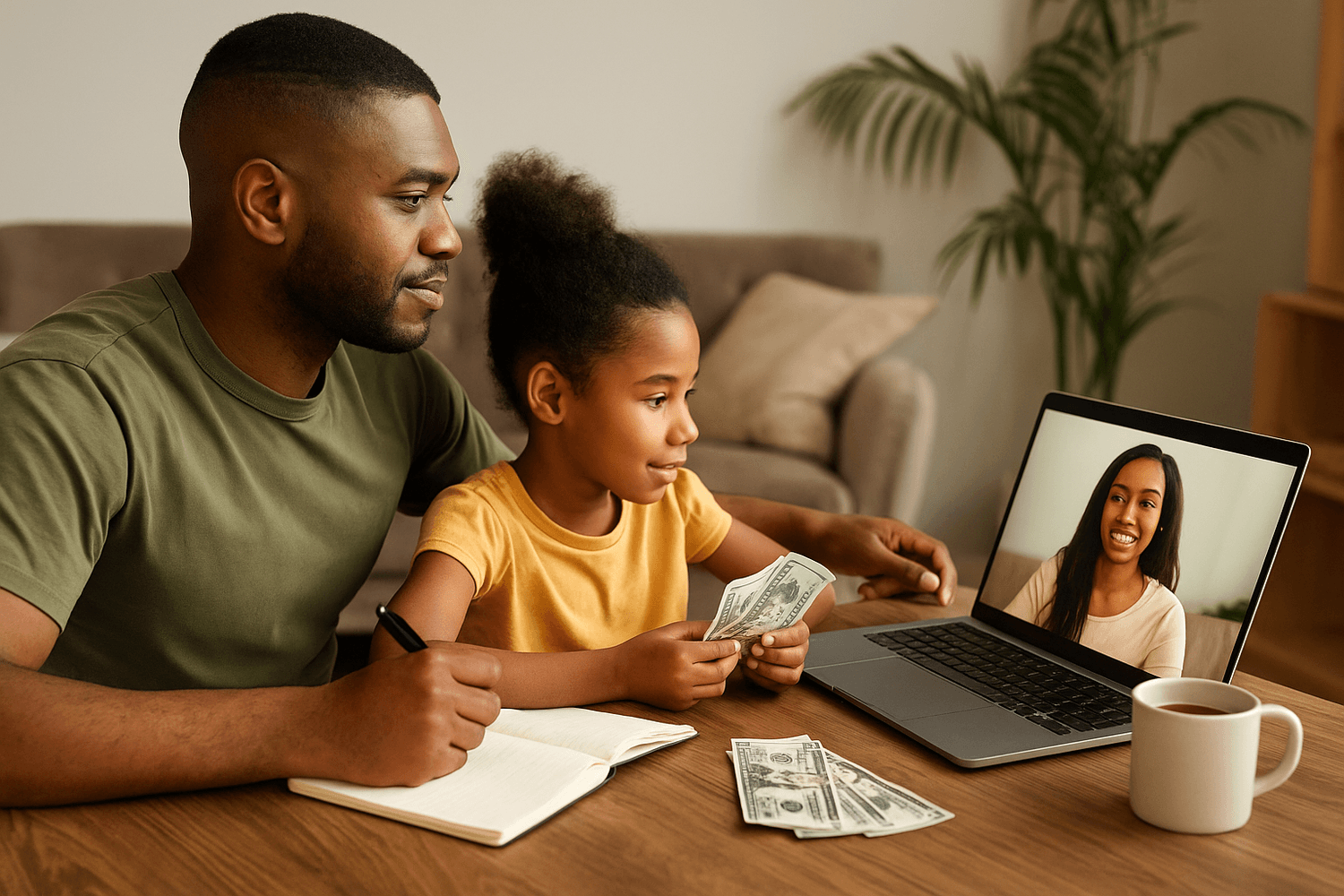

Many soldiers feel the responsibility to support parents, siblings, or extended family. This can be powerful, but it also creates pressure when it competes with your own future.

The Risk of Overextending

Without limits, supporting family back home can:

Drain monthly savings.

Delay investing.

Create resentment if not managed openly.

Set Boundaries That Work

Support doesn’t have to mean sacrifice.

Decide on a set percentage or amount each month.

Use automatic transfers so the giving is steady but contained.

Be transparent with your family about what you can and cannot provide.

This lets you support them while still working toward long-term goals like the 56K Plan.

Final Word

You can help your family and still build wealth. Boundaries, discipline, and smart tools let you provide support without giving up your own financial future. Discipline here accelerates long-term wealth compared to soldiers who don’t set boundaries.

Other Recommended Tools for Soldiers

👉 Banks Hub

Choose a military-friendly bank that makes international or recurring transfers simple.

👉 High Yield Savings Hub

Create a dedicated fund for family support so it doesn’t cut into investments.

More to explore:

Ready to Start Building Wealth While You Serve?

Grab the free guide built for service members who want more than just survival mode. Whether you're in the barracks or deployed overseas, this is your first step toward real freedom.

Helping Soldiers Build Real Wealth While They Serve

We share practical tools, smart financial strategies, and military-friendly resources. Our goal is to help you stop just surviving and start building real freedom.

The information provided by Wealth While You Serve is for educational purposes only and does not constitute financial, legal, or tax advice. Always consult a qualified advisor before making financial decisions. Some links on this site are affiliate links, which means we may earn a small commission at no extra cost to you. This helps us continue offering free resources for military members and their families.

Created with © systeme.io